Marginal tax rate formula

The mathematically driven marginal tax rate formula is as follows. Effective Tax Rate 9574 Tax Payable 63000 Taxable Income 100 152 Marginal Tax Rate vs.

Income Tax Formula Excel University

What is marginal tax rate example.

. For example if a household has a total. Marginal Tax Rate ΔTax Payable ΔTaxable Income. To calculate the marginal tax rate on the investment youll need to figure out the additional tax on the new income.

A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. 1 2018 with the passage of the Tax Cuts and Jobs Act TCJA. Formula Marginal income tax rate can also be defined as the ratio of increase in income tax liability to a 1 dollar increase in taxable income.

Write the formula B2-B3-B4 inside the formula bar and press the Enter key. Marginal Tax Rate ΔTax Payable ΔTaxable Income. Lee is now taxed at four percentages as shown below.

The marginal tax rate on personal income is the percentage of last dollar paid in taxes to government which can be computed using marginal effective tax rates formula. In this example 500 will be taxed at 15 and 500 at. That gain would increase Lees marginal tax rate to 24 on some of that additional taxable income.

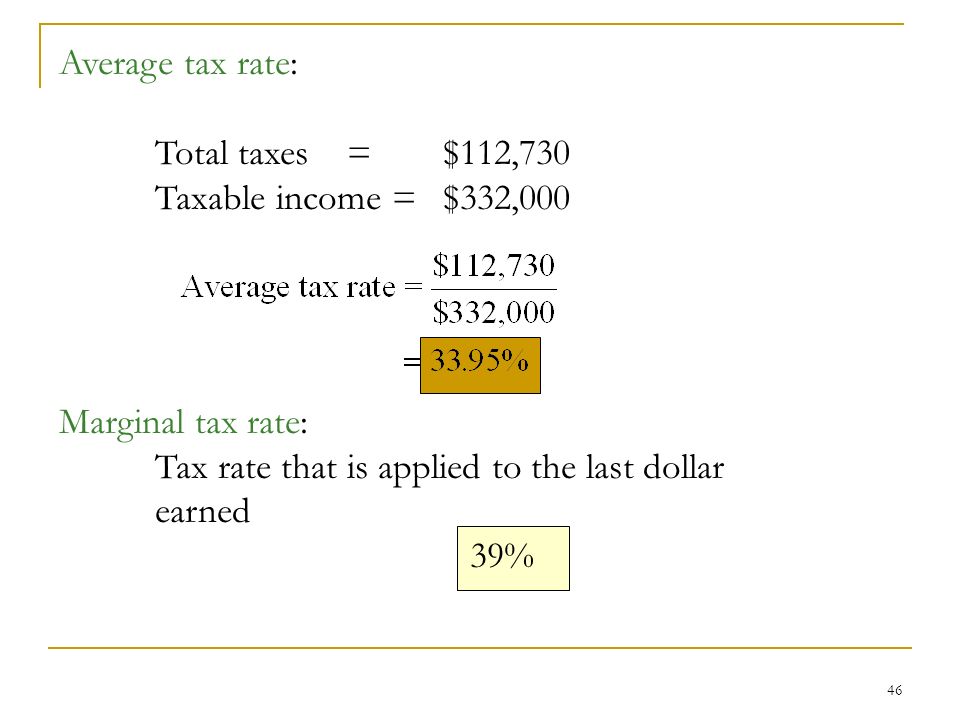

The average tax rate is the total amount of tax divided by total income. The resultant percentage is called the effective tax rate. What is marginal tax rate example.

Average federal tax rate Total taxes paid Total taxable income Your federal average tax rate 171 that is 137039080000 While your federal average tax rate is. How do you calculate marginal tax rate and average tax rate. Effective Tax Rate Formula Effective Tax Rate.

How is marginal tax rate calculated. The average tax rate is the total tax paid divided by total income earned. Taxable income is now extracted from gross income which is 219000.

Earnings before tax EBT. The mathematically driven marginal tax rate formula is as follows. The effective tax rate can be calculated for historical periods by dividing the taxes paid by the pre-tax income ie.

Click into the cell you will place the income tax at and sum all positive numbers in the Tax column with the formula SUM F6F8. Under the previous law the. This can be expressed.

And in the UK for the 201920 tax year the marginal income tax rate was 0 for earnings up to 12500 Personal Allowance the Basic Rate 20 12501 to 50000. The current marginal tax rates went into effect in the United States as of Jan.

Chapter 01 Learning Objective 1 2 Marginal Average Tax Rates And Simple Tax Formula Youtube

Effective Tax Rate Formula And Calculation Example

Marginal Tax Rate Formula Definition Investinganswers

How And Why To Calculate Your Marginal Tax Rate Deliberatechange Ca

What Is Marginal Tax Rate Insurance Noon

Effective Tax Rate Formula Calculator Excel Template

Taxation Calculations Ppt Video Online Download

Net Profit Margin Formula And Ratio Calculator Excel Template

Chapter 8 Accounting For Depreciation And Income Taxes Ppt Video Online Download

Definition Of Effective Tax Rate Fincash

Return On Invested Capital Roic Formula And Calculator Excel Template

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

Marginal And Average Tax Rates Example Calculation Youtube

Excel Formula Income Tax Bracket Calculation Exceljet

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Effective Tax Rate Formula And Calculation Example

Marginal Tax Rate Bogleheads